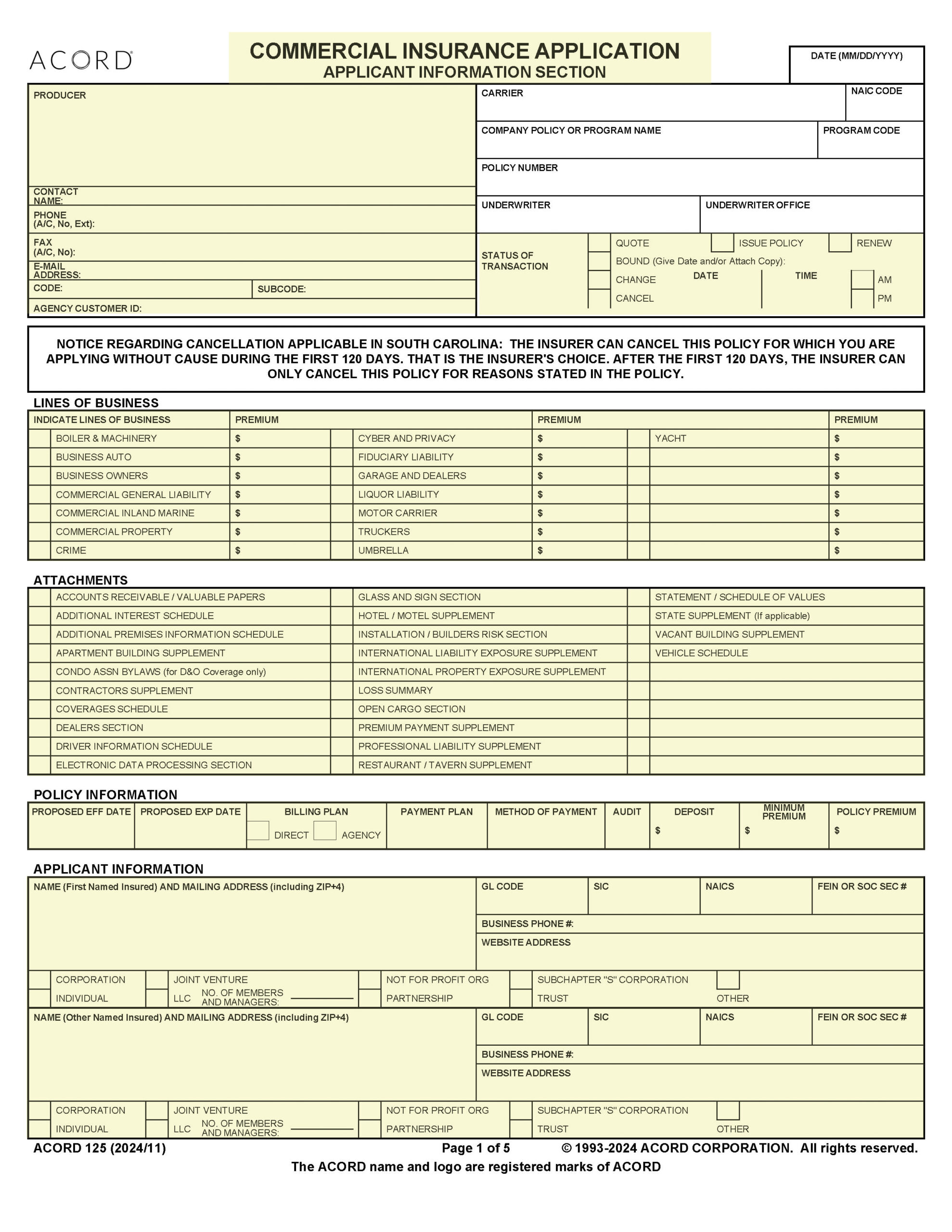

ACORD™ 125

Commercial Insurance – Applicant Information

Get to know the ACORD™ 125 — the foundation of commercial insurance applications and your first step in mastering new business submissions.

PAGE 1

Form Key

1. Commercial Insurance Application

ACORD 125, Commercial Insurance Application, Applicant Information Section, is used in the underwriting process for any commercial account submission. The Applicant Information Section is the foundation on which the ACORD commercial application program is built. This form contains information that is not duplicated on other ACORD commercial application forms. The Applicant Information Section is a required part of every commercial submission except Workers Compensation and no commercial application is complete without it.

2. Agency Producer Information

Name of agency/producer, Contact Name, Phone Number, Fax Number, Email address and Agency Code.

3. Status of Submission

Check the appropriate box for the status of the transaction and provide the date and time the application is completed.

4. Line of Business

Select all of the lines of business/coverages to be included on the policy.

5. Attachments

Select all of the attachments/supplemental applications that are part of this submission.

6. Policy Information

Provide the proposed effective date and expiration date for the coverage, billing plan, payment plan and other billing related information that applies.

7. Applicant Information

Provide the name of the first named insured and mailing address as they should appear on the policy declarations.

In addition, provide the type of business entity (corporation, individual, joint venture, partnership, etc.). Also provide the class codes, FEIN #, Business phone number and website address. The same information should be provided for Other named insureds.

PAGE 2

Form Key

1. Contact Information

Provide the full name, phone number and email address for the contact for premium audit, loss control and claims.

2. Premises Information

In this section, enter the location number, building number, Address for each premises. Indicate whether the property is inside or outside city limits. Indicate whether the policyholder is the owner or tenant at that location. Also include number of full time and part time employees, annual revenue, area occupied, area open to the public, total building area and whether any area is leased to others. Include the description of what business the applicant performs and the way it is conducted by premises. Operations that may not be apparent in a general description of operations may be segmented by location. The section should be completed in enough detail to enable the underwriter to understand and classify each operation. Do not use the classification wording from the Commercial Lines Manual or Workers Compensation Manual. They do not provide adequate detail.

3. Nature of Business – Description of primary operations

Select the nature of the business that applies to the applicant. If “other” is select provide details is the description of primary operations section.

4. Date Business Started

Enter the date the applicant began in business. This is important because it helps the underwriter determine the expertise and business success of the applicant.

5. Retail stores or service operations % of total sales:

Enter percentage of total sales attributed to installation, service or repair work and the percentage of toal sales attributed to off premises installation, service or repair work.

6. Description of operations of other named insureds

Use this section to describe the operations of other named insureds.

PAGE 3

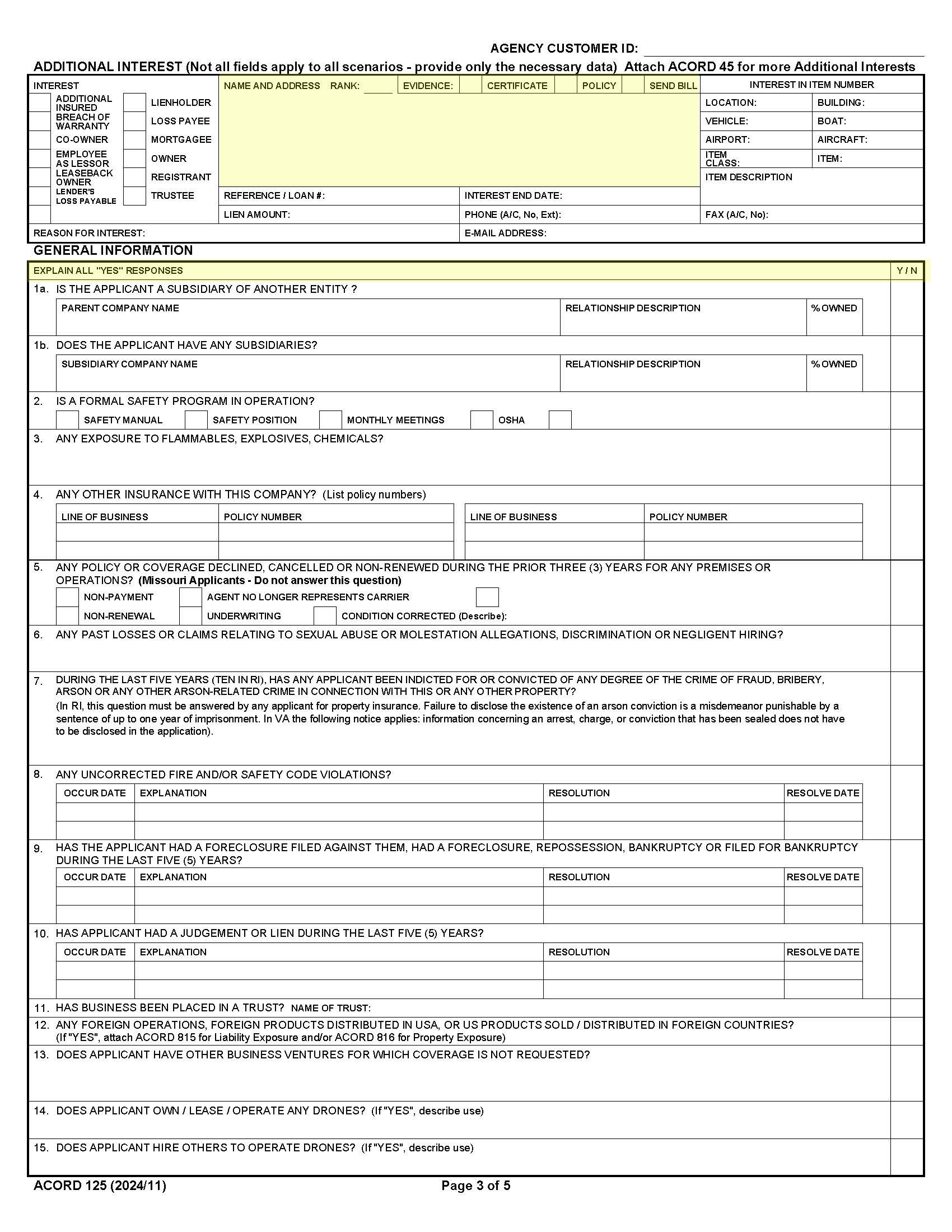

Form Key

1. Additional Interest

Indicate the additional interest type, the name and address of the additional interest, reason for interest and what item on the policy the additional interest applies to (ie location, building, vehicle, item).

2. General Information

Answer all of the questions in this section. Explain all “yes” responses. If additional space is required use the “Remarks” area on page 4.

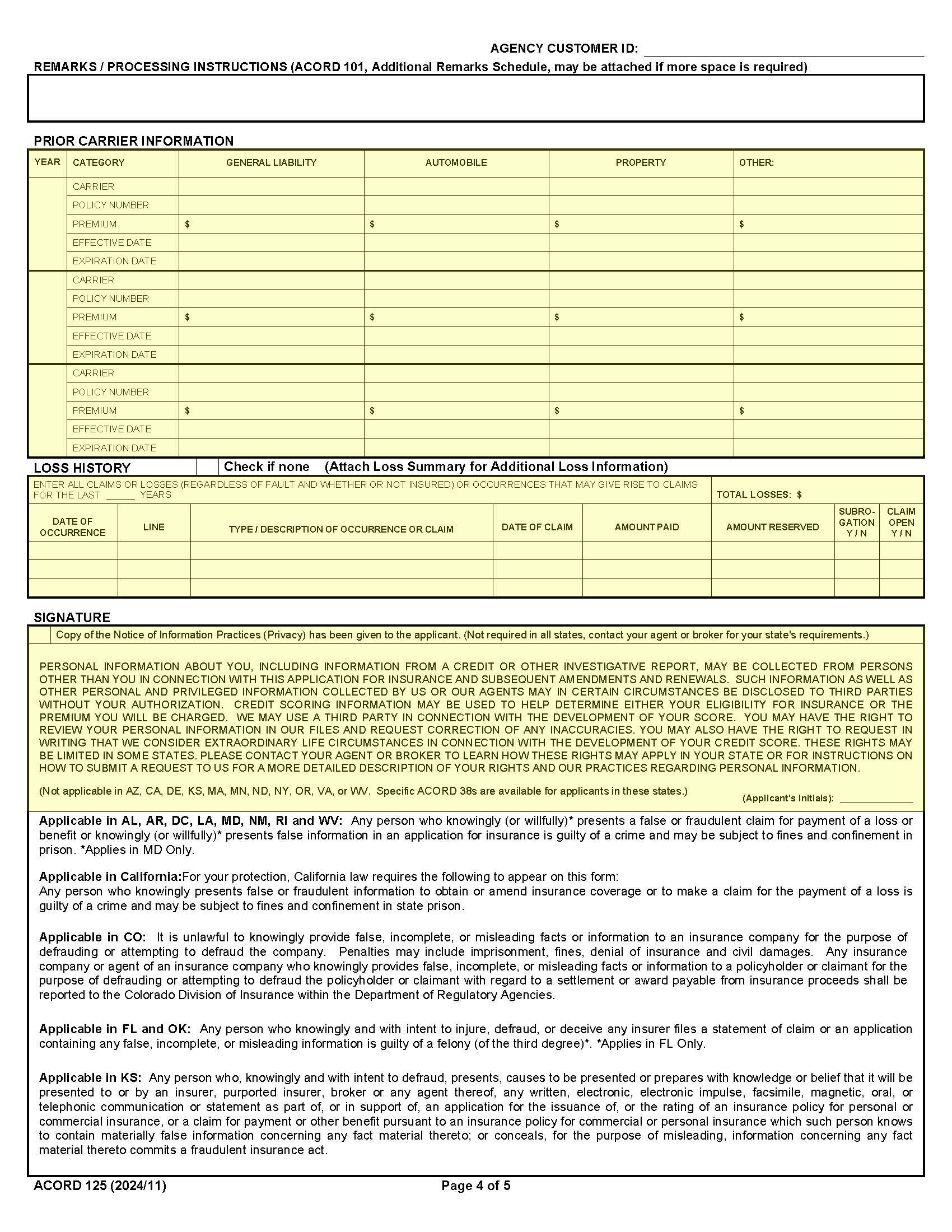

PAGE 4

Form Key

1. Prior Carrier Information

In this section, provide the prior carrier information for the past 3 years. This includes the name of the prior carrier, policy number, premium, effective date and expiration date for each policy.

2. Loss History

Use the “Check if None” box to indicate there are no prior losses or occurrences that may give rise to claims for the past 3 years. For any claims during the past 3 years, provide the date of the occurrence, line of business, type/description of the occurrence or claim, date of claim, amount paid, amount reserved, indicate whether subrogation applies and if the claim is open.

3. Signature

For NY applicants, indicate whether a copy of the Notice of Information Practices (ACORD 38) has been given to the applicant. The applicant must initial in that section.

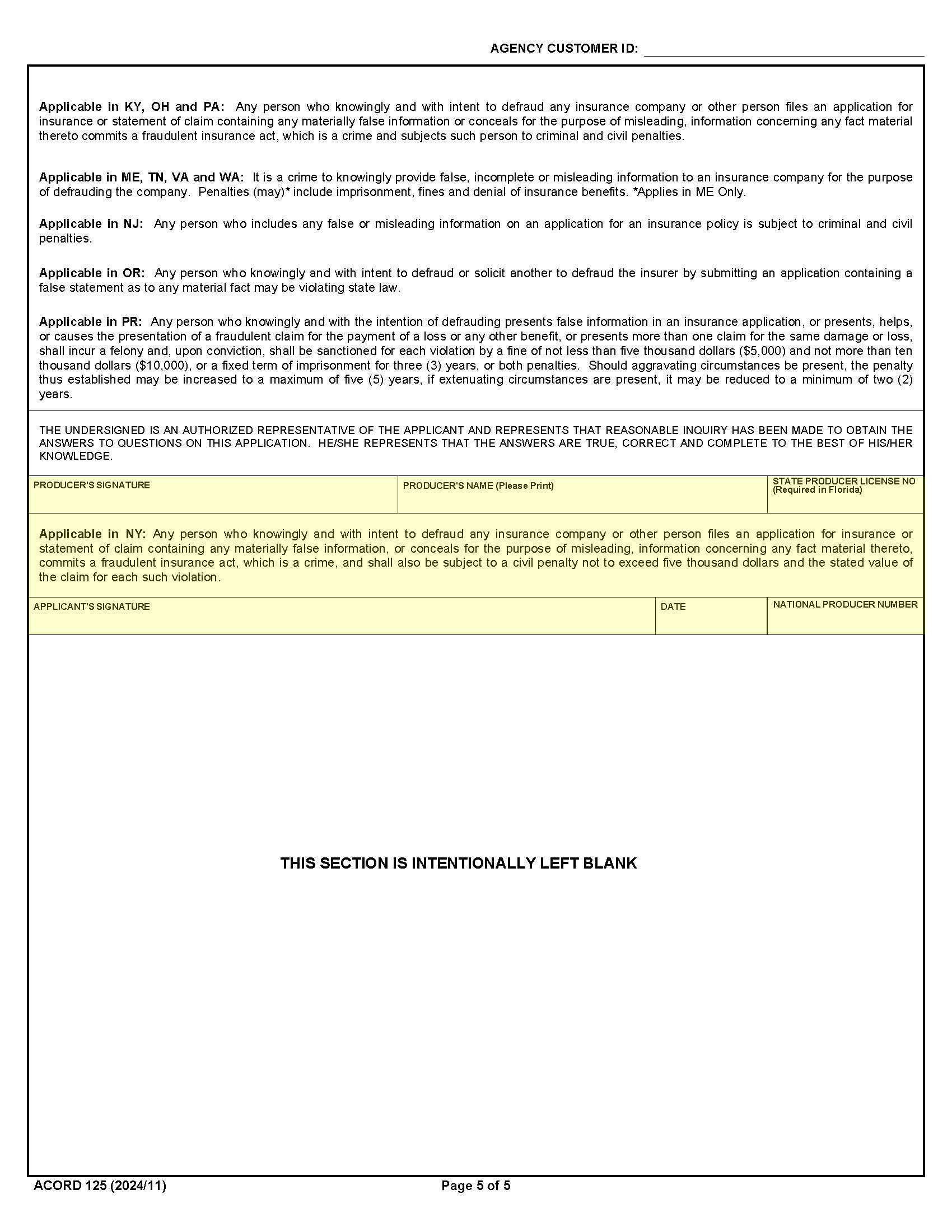

PAGE 5

Form Key

1. Signature (continued)

The applicant and the producer must sign and date the completed application.