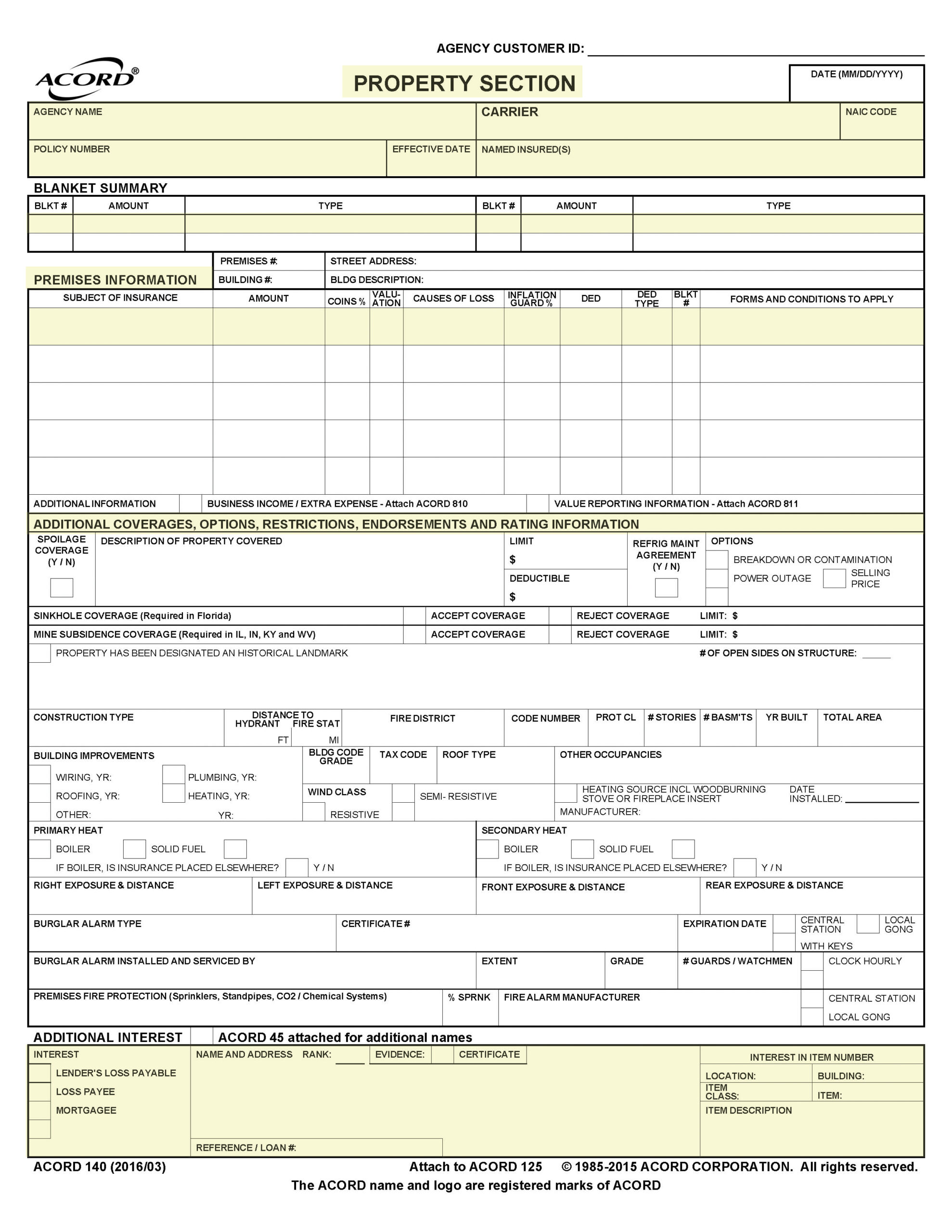

ACORD™ 140

Commercial Property

Get to know the ACORD™ 140 — the go-to form for documenting commercial property details, including building information, coverages, and protection systems.

PAGE 1

Form Key

1. ACORD 140 Property Section

ACORD 140, Property Section, has been designed to handle the basic underwriting and rating needs for commercial property exposures. The Property Section accommodates two locations, with coverage and rating information recorded separately for each location. This form was designed to be used in conjunction with ACORD 125, Commercial Insurance Application, Applicant Information Section. Much of the information for the Identification Section should match the data found within the Applicant Information Section of ACORD 125. Nevertheless, it is still important to complete it. Many companies separate the applications by line of business for rating purposes. Not completing this portion of the application makes it difficult to keep track of the full account.

2. Agency, Carrier, Policy Number, Effective Date and Named Insured(s)

Enter Agency Name, Carrier Name, Policy Number, Effective Date and Name of Insured(s).

3. Blanket Summary

Enter the blanket number, the maximum amount for the blanket and the blanket type – Building, Contents or Combined Building and Contents.

4. Premises Information

Enter the premises #, building #, Street Address and building description.

5. Subject of Insurance

Enter the code designating all subject of coverages that are to be insured at this particular location number/building number combination. Examples:

B – Building

BUSEE – Business Income without Extra Expense

BUSIN – Business Income with Extra Expense

BUSER – Business Income with Extra Expense and Rental Value

BUSRN – Business Income with Rental Value without Extra Expense

BPP – Business Personal Property

EE – Extra Expense

FF – Furniture & Fixtures

MACEQ – Machinery, Equipment

PP – Personal Property

POTOP – Property of Others

STK – Stock

6. Amount

Enter the limit representing the maximum amount of coveage provided for this subject of insurance.

7. Coins %

Enter percentage: The Coinsurance Percentage is the percentage of the total value of the subject of insurance being insured. If the amount of insurance falls below this percentage, the insured must share in the amount of the loss. This field should be completed even when writing agreed amount coverage.

8. Valuation

Enter code: Indicate the method which will be used to determine the amount paid on a claim. If other valuation basis applies, provide necessary information. Options Include:

A – Actual Cash Value

R – Replacement Cost

V – Agreed Amount

M – Market Value

9. Causes of Loss

Enter code for the causes of loss the subject of insurance is to be covered for. Examples:

- Basic

- Broad

- Special excluding theft

- Earthquake

10. Inflation Guard %

Enter percentage: The inflation guard percentage gives an automatic increase in the amount of coverage based on a percentage over time. List both the percentage amount and the period of time during which it applies (e.g., 4% per year).

5. Deductible, deductible type

Enter the deductible amount that is to apply to this subject of insurance. Enter the code indicating the type of deductible that is to apply to this subject of insurance. Examples are percent, dollars and number of days. “Number of days” is used to describe the waiting period (deductible) for business income.

12. BLKT #

Enter the identifying number for the blanket under which this subject of insurance is rated. Leave blank if the subject of insurance is not included under a blanket.

13. Forms and conditions to apply

Enter the form numbers and special conditions that apply to this subject of insurance. Also indicate here if coverage is blanket or average rated.

14. Additional Coverages, Options, Restrictions, Endorsements and Rating Information

For the particular location number/building number combination enter the information for additional coverages desired, rating information for the risk and risk characteristics including construction, protection class, year built, number of stories, area of the building, distance to adjacent properties and protective device info including burglar and fire alarms and sprinkler systems or other extinguishing systems. For construction type enter one of the following:

- Frame

- Joisted Masonry

- Non-Combustible

- Masonry Non-Combustible

- Modified Fire Resistive

- Fire Resistive

15. Additional Interest

Check the box for the applicable type of additional interest. Provide the name and address of the additional interest. Check the box if the additional interest requires a Certificate of Insurance. Indicate the location and building number or the item for which the additional interest applies.

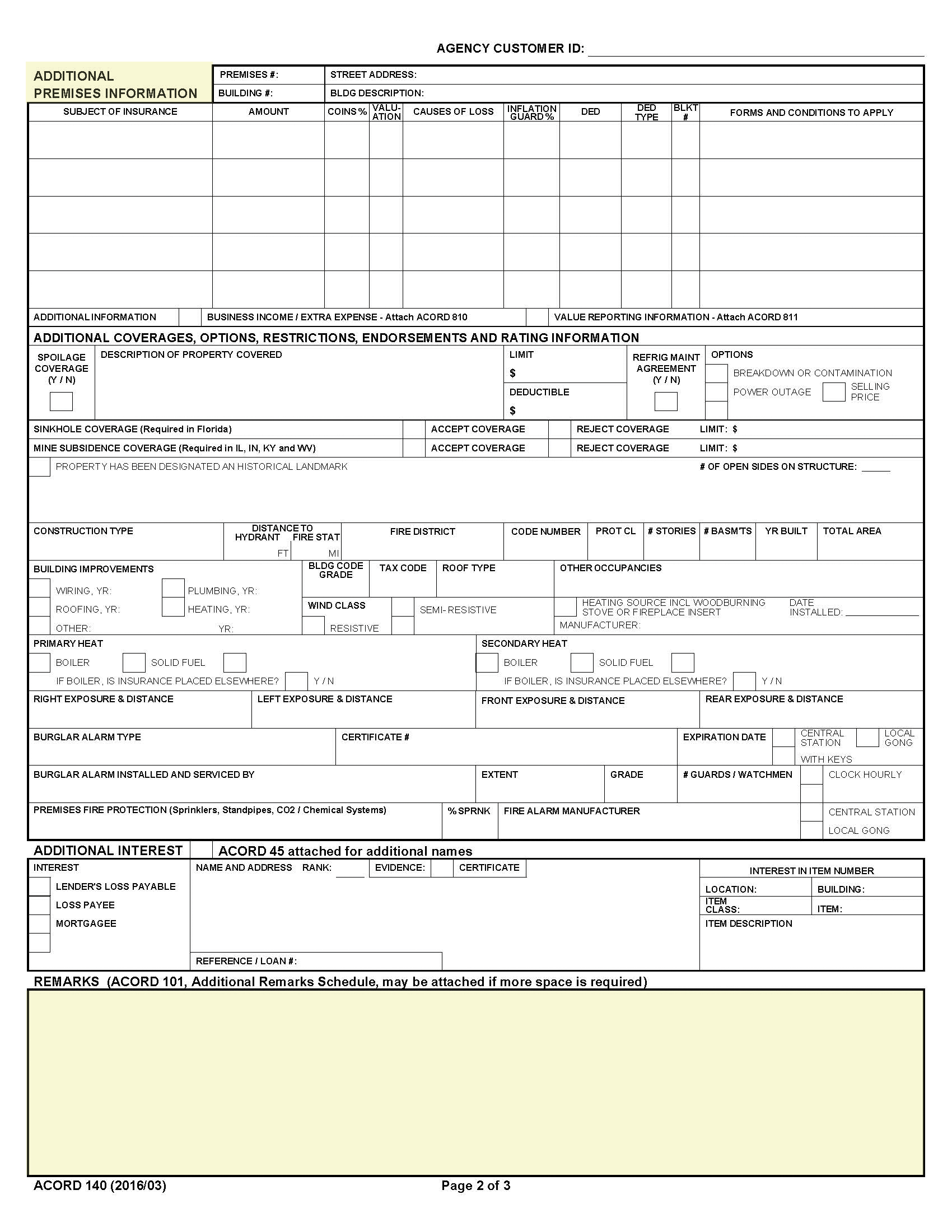

PAGE 2

Form Key

1. Additional Premises Information

The same information that was required on Page 1 is required for each additional location/building combination. Use this page to provide information for each location/building.

2. Remarks

Use this section to provide any additional information relating to the property coverage requested.

PAGE 3

Form Key

1. Signature/Date

Producer and applicant signatures are required along with the producer name. state licensed and date.