In 2021 Merchants Insurance Group launched a donation incentive to encourage policyholder enrollment in the company’s paperless billing and policy document delivery services: pledging donations of $1 to Mothers Against Drunk Driving® (MADD) for each policyholder who signs up to go paperless.

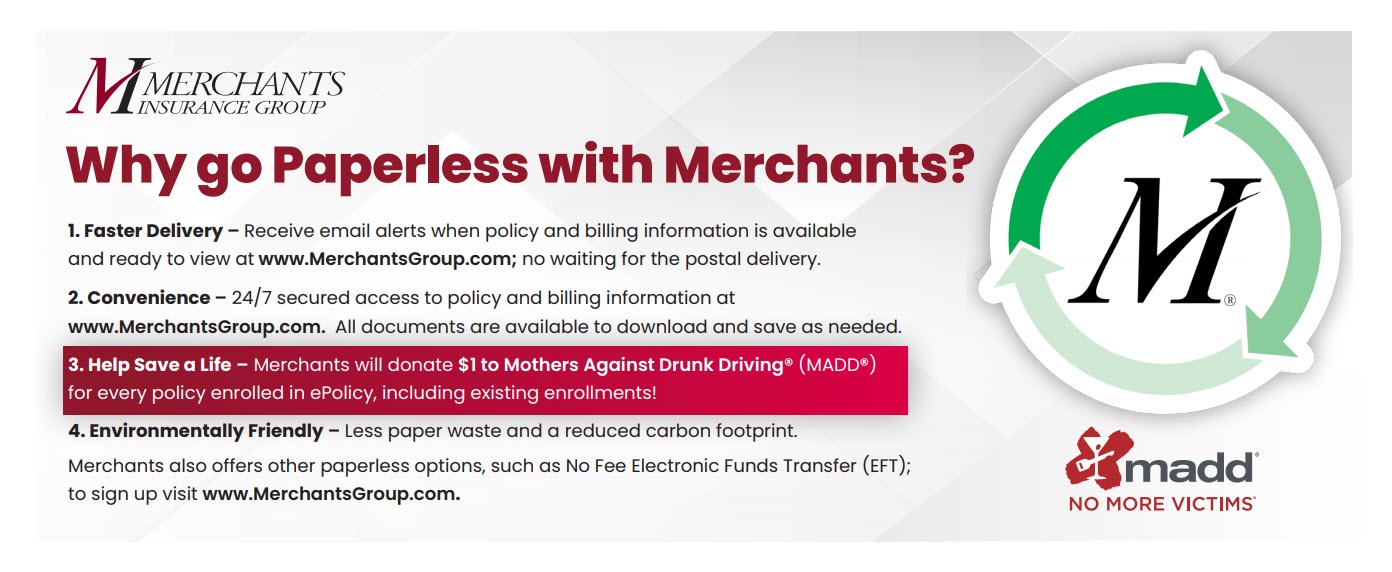

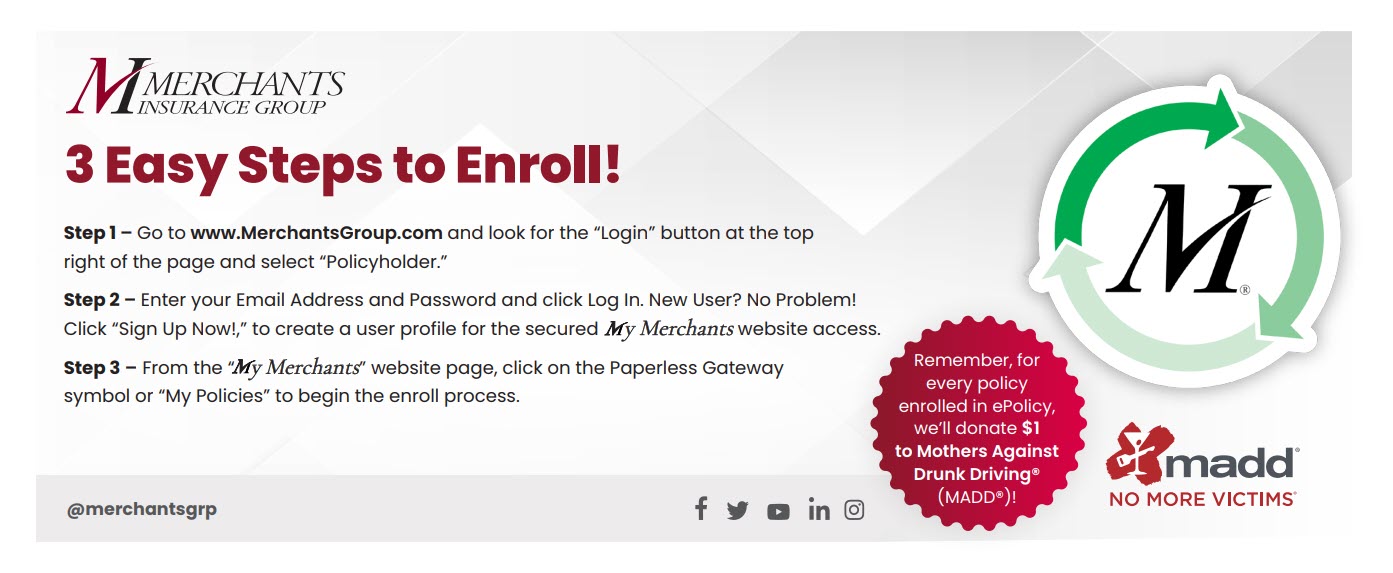

As part of this ongoing initiative, Merchants has been including inserts in all hard copy insurance bills and electronic fund transfer (EFT) statements since June 2021. The inserts contain information about the benefits of going paperless and steps on how to enroll in Merchants’ paperless services, as well as information about the donation:

Front:

Back:

Merchants is thrilled to continue donating to MADD® as part of its ongoing Go Paperless campaign.

About Mothers Against Drunk Driving

Founded in 1980 by a mother whose daughter was killed by a drunk driver, Mothers Against Drunk Driving® (MADD) is the nation’s largest nonprofit working to end drunk driving, help fight drugged driving, support the victims of these violent crimes and prevent underage drinking. MADD has helped to save more than 400,000 lives, reduce drunk driving deaths by more than 50 percent and promote designating a non-drinking driver. MADD’s Campaign to Eliminate Drunk Driving® calls for law enforcement support, ignition interlocks for all offenders and advanced vehicle technology. MADD has provided supportive services to nearly one million drunk and drugged driving victims and survivors at no charge through local victim advocates and the 24-Hour Victim Help Line 1-877-MADD-HELP. Visit www.madd.org or call 1-877-ASK-MADD.